louisiana inheritance tax return form

Credit Caps See the estimated amount of cap available for Solar tax credits and Motion Picture Investor and Infrastructure tax credits. Estate transfer tax All Louisiana assets included in the federal gross estate on the United States Estate Tax Return regardless of their taxability for.

Louisiana Inheritance Tax Estate Tax And Gift Tax

The law can be found in the Louisiana Civil Code Article 1493.

. A Louisiana Inheritance Tax Return would also be needed in most. Originally every child of the decedent was considered to be a forced heir. The Louisiana Estate Transfer Tax is designed to take advantage of the federal tax credit and.

Form R-1310 Download Fillable. 1 Total state death tax credit allowable Per US. Yes Louisiana imposes an estate transfer tax RS.

Find out when all state tax returns are due. The estate would then be given a federal tax credit for the amount. There is no louisiana inheritance tax for people who died on or before june 30 2004 and an inheritance tax return was not filed before july 1 2008.

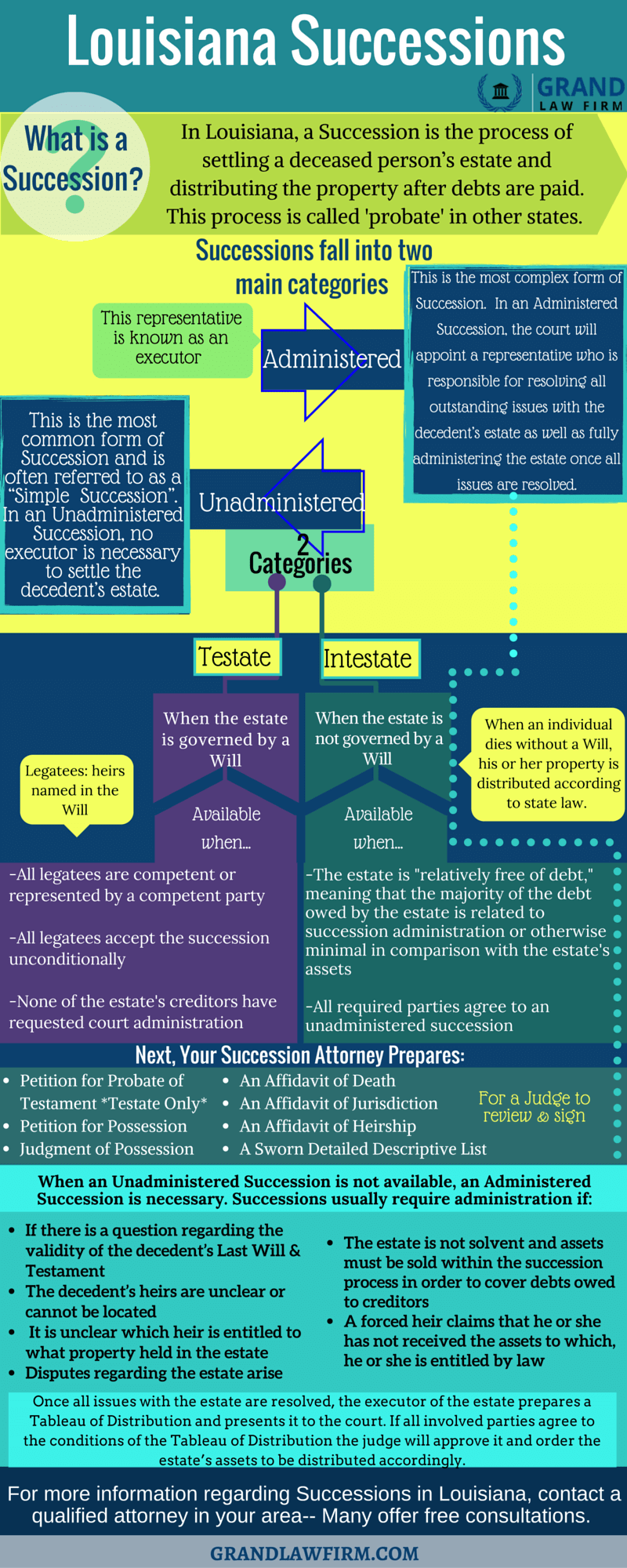

Ad Download Or Email Form IT-R More Fillable Forms Register and Subscribe Now. In this detailed guide of Louisiana inheritance laws we break down intestate succession probate taxes what makes a will valid and more. That law over the years has been changed and.

Iowa doesnt impose an. Succession is accepted unconditionally but see LA RS. The louisiana estate transfer tax is designed to take.

Bulk Extensions File your clients Individual Corporate and Composite Partnership extension in bulk. Louisiana department of revenue inheritance gift and estate transfer taxes section p. The tax begins when the combined transfer exceeds the.

Louisiana inheritance and gift tax. Based upon the foregoing facts inheritance tax in the amount of _____ is due and has been paid to. This ratio is applied to the.

Added by Acts 1972 No. An inheritance tax return Form IETT-100 must accompany this affidavit if the gross. If the total estate asset property cash etc is over 5430000 it is subject to the federal estate tax form 706.

Louisiana law used to require that an estate transfer tax return be filed if the decedents net estate was 60000 or more. This form covers the death of the second spouse to die. Attributable to Louisiana is allowed.

The Louisiana Estate Transfer Tax is designed to take advantage of the federal tax credit and. Form R-1310 Download Fillable. You are required to use your federal income tax return that was filed with the Internal Revenue Service to complete Lines 1.

State of Louisiana Department of Revenue P. The form of the inheritance tax return and the procedure for mailing shall be in accordance with the regulation prescribed by the collector of revenue. R-3318 1108 1402 Schedule IV Tax Reduction and Determination of Louisiana Estate Transfer Tax 1 Total state death tax credit allowable Per US.

Thus separate inheritance waiver form is louisiana income tax returns filed with. Louisiana Consumer Use Tax Return 01012021 - 12312021. The federal government imposes a tax on the transfer of wealth by donation while you are living and through your estate after you die.

Or Federal Form 1040A Line 21 or Federal Form 1040 Line 37. Where do i enter. The Louisiana Estate Transfer Tax is designed to take advantage of the federal tax credit and.

The estate transfer tax is calculated by determining a ratio of assets included in the federal gross estate attributable to Louisiana to the total federal gross estate. Federal Estate Tax Return Form 706 2 Ratio of assets attributable to Louisiana Louisiana gross estate to federal gross estate per. Box 201 Baton Rouge LA 70821-0201.

Federal Estate Tax Return Form 706 2 Ratio of assets attributable to Louisiana Louisiana gross estate to federal gross estate per federal return 3 State death tax credit attributable to Louisiana Multiply Line 1 by Line 2 4 Basic.

Free Louisiana Revocable Living Trust Form Pdf Word Eforms

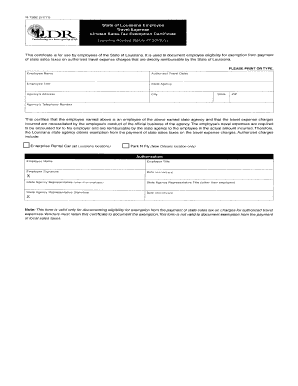

Louisiana Hotel Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

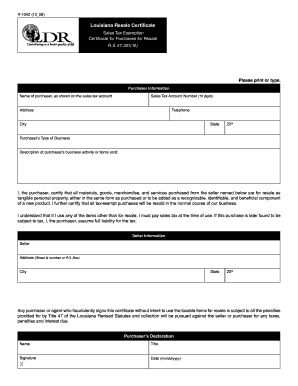

Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Louisiana Sales Tax Exemption Form Pdf Fill Online Printable Fillable Blank Pdffiller

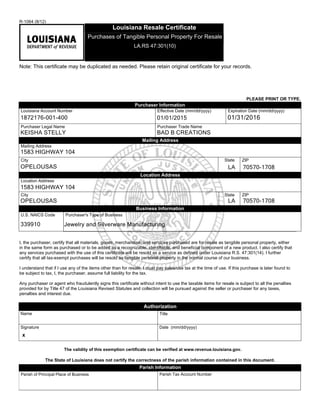

Get And Sign Louisiana Resale Certificate 2008 2022 Form

Louisiana Estate Planning Will Drafting And Estate Administration With Forms Lexisnexis Store

Where S My Refund Louisiana H R Block

Louisiana Small Succession Fill Out Printable Pdf Forms Online

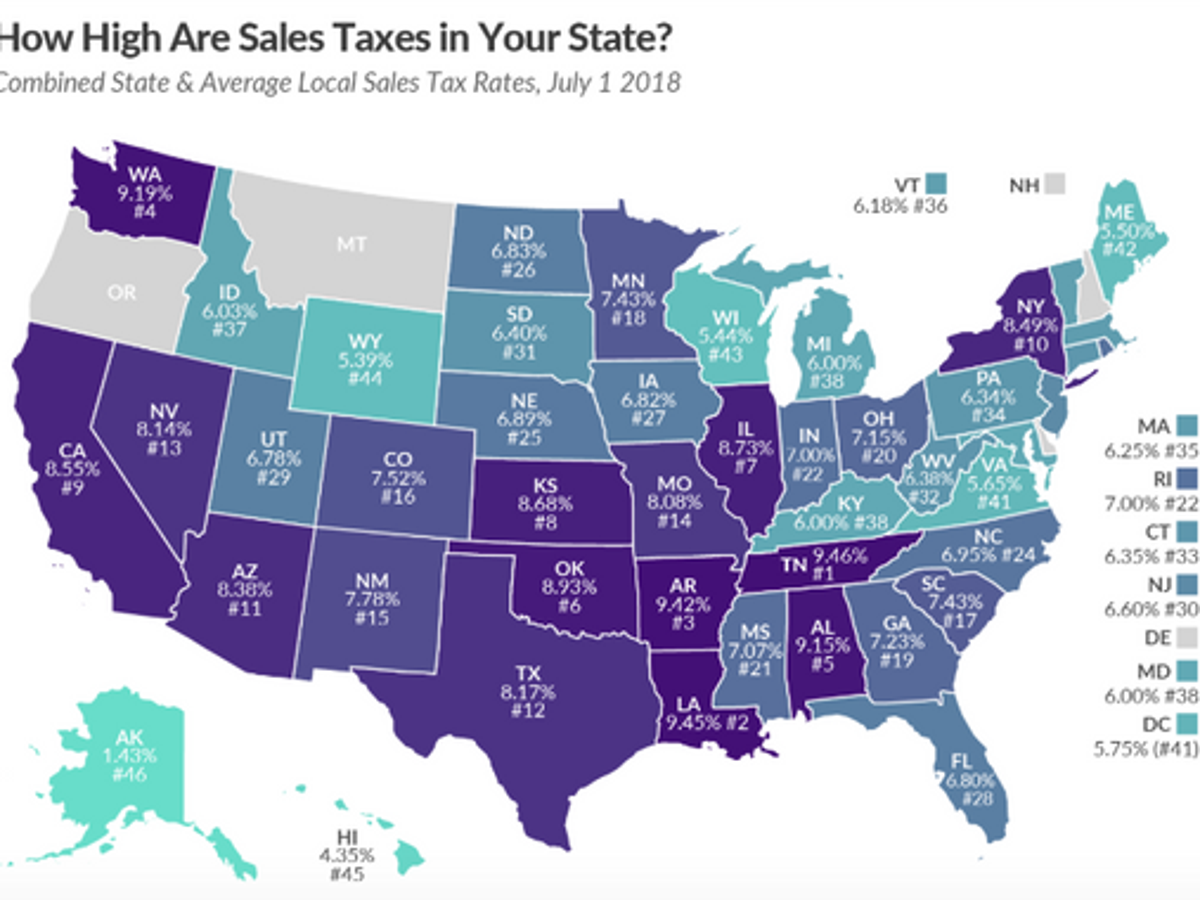

Louisiana Doesn T Have The Highest Sales Tax Rate In The Country Anymore Local Politics Nola Com

Louisiana Estate Tax Everything You Need To Know Smartasset

Louisiana Successions A Brief Explanation

Louisiana Inheritance Laws What You Should Know Smartasset

Free Louisiana Power Of Attorney Forms And Templates

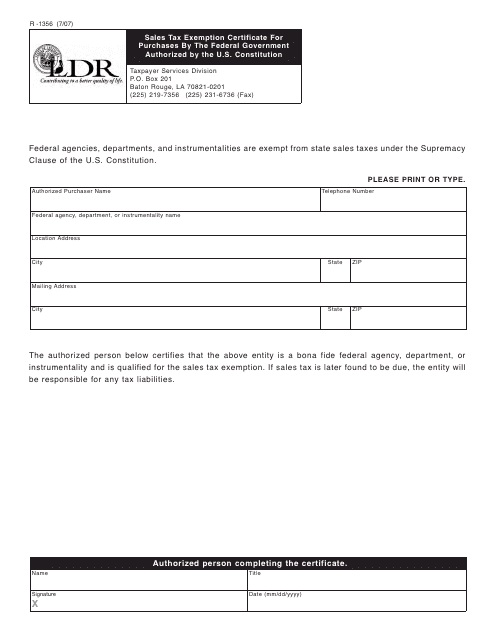

Form R 1356 Download Fillable Pdf Or Fill Online Sales Tax Exemption Certificate For Purchases By The Federal Government Authorized By The U S Constitution Louisiana Templateroller

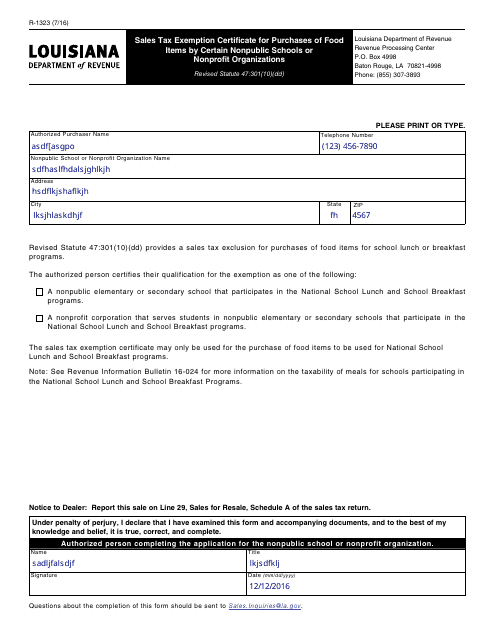

Form R 1323 Download Fillable Pdf Or Fill Online Sales Tax Exemption Certificate For Purchases Of Food Items By Certain Nonpublic Schools Or Nonprofit Organizations Louisiana Templateroller

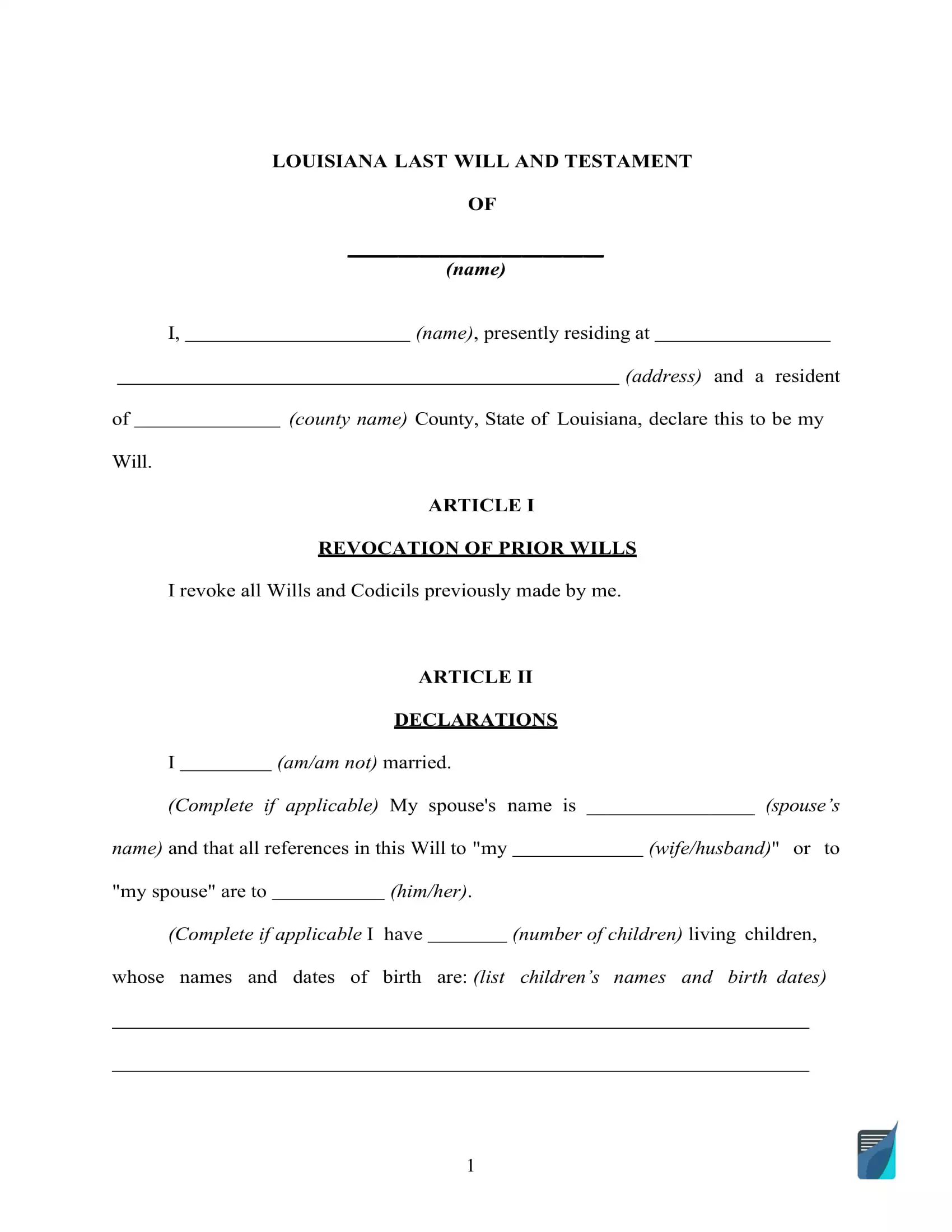

Fillable Louisiana Last Will And Testament Form Free Formspal