iowa inheritance tax rate

0-12500 has an Iowa inheritance tax rate of 5. Iowa Estate Tax Iowa estate tax is not applicable.

Iowa Legislature Sends Significant Tax Bill To The Governor Center For Agricultural Law And Taxation

For deaths on or after 7197 property passing to the surviving spouse is.

. In addition to the Iowa inheritance tax there are other Iowa state taxes which concern estate property. A bigger difference between the two. Inheritance Tax Rates and Exemptions.

1 INHERITANCETAX4501 CHAPTER450 INHERITANCETAX Thischapterisinapplicableandtheinheritancetaxshallnotbeimposedonthe. Iowa Inheritance and Gift Tax. You Are Here.

In the meantime there is a phase-out period before the tax completely disappears. In 2021 Iowa decided to repeal its inheritance tax by the year 2025. These tax rates are based upon the relationship of the beneficiary to the deceased with no inheritance tax due from spouses and direct lineal descendants or ascendants ie.

Iowa Inheritance Tax Rates The Iowa inheritance tax rate varies depending on the relationship of the inheritors to the deceased person. It has an inheritance tax with a top tax rate of 18. Main Page State Taxes Iowa Iowa Inheritance and Estate Taxes Iowa inheritance tax history.

There are Tax Rate C beneficiaries which applies to uncles aunts nieces nephews foster children cousins brothers-in-law sisters-in-law and all other individuals. See IA Inheritance Tax Rates 60-061 iowagov for current tax rates and see Iowa Inheritance Tax Ag Decision Maker iastateedu for a more detailed account of how inheritance tax. 12501-25000 has an Iowa inheritance tax rate of 6.

That is worse than Iowas top inheritance tax rate of 15. How much is the inheritance tax in Iowa. Up to 25 cash back Update.

For deaths prior to 7197 there is no inheritance tax on property passing to the surviving spouse from the decedent. Iowa does have an inheritance tax which beneficiaries are responsible for paying on their inheritance. 25001-75500 has an Iowa inheritance tax rate of 7.

There are a number of categories. Iowa does not levy an inheritance tax in cases where the decedents entire net estate is valued at 25000 or less. These tax rates are based upon the relationship of the beneficiary to the deceased with no inheritance tax due from spouses and direct lineal descendants or ascendants ie.

Iowa is also working on phasing out its inheritance tax by. A summary of the different categories is as follows. These are briefly described below.

How Much Is Inheritance Tax Community Tax

Inheritance Tax Penalizes Those Already Suffering Itr Foundation

Estate And Inheritance Taxes Urban Institute

Flat Tax Backed By Majority Of Iowans Not Corporate Cuts Iowa Poll

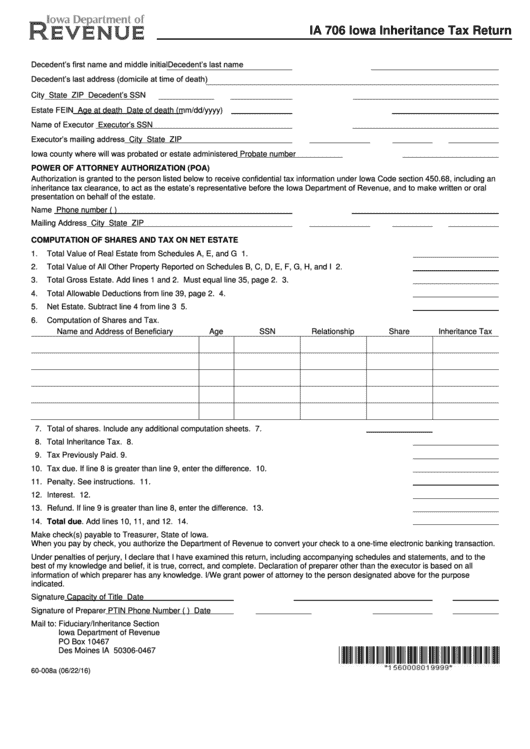

The Inheritance Tax In Iowa How To File

State Estate And Inheritance Taxes Itep

Atr Eliminate Iowa S Death Tax Iowans For Tax Relief

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Another State Ditches Its Death Tax While Potential Backdoor Federal Estate Tax Looms

Is Your Inheritance Taxable Smartasset

Estate Tax Definition Tax Rates And Who Pays White Coat Investor

Iowa Inheritance Tax A Thing Of The Past In The Future

Form Schedule G H Inheritance Tax Rate Schedule Schedule G H

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

Historical Iowa Tax Policy Information Ballotpedia

Iowa Lawmakers Pass Massive Tax Cut Iowa Capital Dispatch

Estate Taxes In Europe Estate Inheritance Gift Taxes Tax Foundation

Iowa State Economic Profile Rich States Poor States

Tax Talk If You Die In Iowa Is There A State Estate Tax Gordon Fischer Law Firm